You need a lot to start. Then, the more you have, the more you get. This sounds like a "rich get richer" scenario to me.

It sounds like a process that consolidates wealth in the hands of a small number of large asset holders. It sounds like the inequitable balance of wealth in today's society.

It sounds like the model decentralization is intended to break.

Yet early Proof of Stake (PoS) systems are encouraging this model. Rather than encouraging decentralization, they're encouraging re-centralization.

This is happening in two ways. The first is requiring a PoS validator to hold a large number of assets to even BECOME a validator in the first place.

Then, these systems reward validators proportionally, based on the amount of assets they hold. The more assets a validator holds, the more rewards they receive.

Big Buy-In's

For example, Loom requires an entity to hold 1,250,000 LOOM tokens to become a validator. That's about $50k at the time of this writing. Engima anticipates requiring about 20k ENG tokens or roughly $6.7k right now.

You'd need about 33k LPT or $154k to break into the active Livepeer Transcoder set. Full disclosure, I'm fortunate to be in the active set.

It's worth noting the 33k LPT buy-in is a result of staking behavior, not a project-defined threshold. The planned Streamflow release intends to eliminate or at least reduce this entry barrier.

Ethereum plans to require 32 ETH to stake when the chain implements PoS. In comparison,that looks like a bargain at about $3.5k today.

Many of the large holders are early project investors, having participated in events like pre-sales. What happens is they turn around and stake to their own validators or validators they've invested in.

The Rich Get Richer

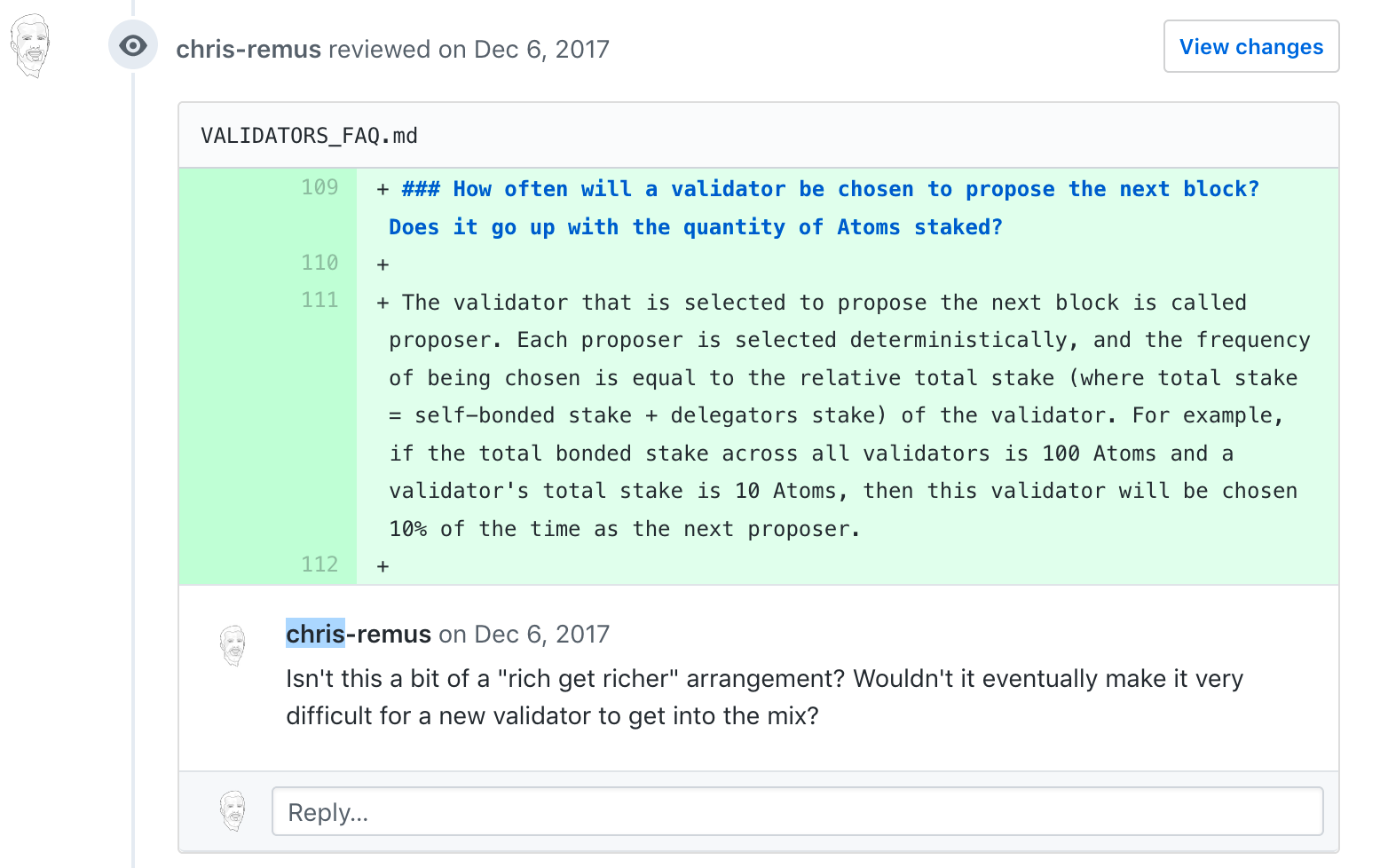

Then these big piles get bigger through inflationary and block rewards. Inflation is based on a percentage of total stake. Block reward proposers get chosen proportionally, based on total stake.

So the higher the stake, the more inflation is received and the more often a validator gets chosen to propose a block. This increases the gap between the haves and have nots. It makes it even harder for new validators to break into the picture. Cosmos and Enigma are two examples of this.

I’m feeling excited to experiment with running @EnigmaMPC staking nodes. Yet I’m feeling disappointed to see this “...the greater your stake, the greater the cumulative rewards you can earn, as your likelihood to be sampled increases proportionally...” https://t.co/6PRQpGpkAV

— Chris Remus (@cjremus) November 25, 2018

But Doesn't It Have to Be This Way?

Loom thinks this is OK because while only a select few can operate validators, ANYONE can stake to them. To me, this is analogous to saying only a few can operate banks, yet anyone can deposit to them.

I’m feeling excited to experiment with running @EnigmaMPC staking nodes. Yet I’m feeling disappointed to see this “...the greater your stake, the greater the cumulative rewards you can earn, as your likelihood to be sampled increases proportionally...” https://t.co/6PRQpGpkAV

— Chris Remus (@cjremus) November 25, 2018

The common argument for systems to operate like this is the high buy-ins increase network security. I see the possible validity of the argument.

Well capitalized validators might be more "serious" about running their systems. There's no guarantee this is the case. The argument also provides convenient cover for the well capitalized funds to say they're investing in decentralization.

Yet I don't quite buy it.

To me, the set of validators should be self-selected by the token holders. Exclusive and restrictive requirement specification shouldn't define the set. My sense is if networks dropped the high buy-in requirements, for example, poorly performing validators would drop out too.

This is fundamental to PoS operation. If token holders choose to stake to poorly performing validators, then this is another problem altogether.

I have a difficult time accepting that, w/all the brilliant minds thinking about #ProofOfStake & #GeneralizedMining systems, the most equitable fee/reward distributions available so far are rich-get-richer ones, i.e. the more stake accumulated, the more fees/rewards received ?

— Chris Remus (@cjremus) December 19, 2018

My sense is that with all the brilliant minds working on PoS today, we can do better than this centralizing rich get richer arrangement. I'm hopeful we will do better.

I've been running a Cosmos testnet validator for over a year with this hope. I currently hold no Atoms whatsoever. This would make it difficult if not impossible to run on the Cosmos production network.

If we don't, then we'll continue encouraging re-centralization, rather than encouraging decentralization. And at the point, what's the point at all?

Join the Conversation on Twitter ?

Here's why I fear early #ProofOfStake systems are encouraging re-centralization, rather than decentralization ? https://t.co/jJNvI2zL9C pic.twitter.com/6PmrD4O9x3

— Chris Remus (@cjremus) December 29, 2018