Balancing Incentives, System Robustness, and Efficiency in Decentralized Systems

Learnings and recap of the Columbia Crypto Economics Workshop

The Columbia Crypto Economics Workshop brought together researchers and practitioners to explore the intricate economic and game-theoretic challenges in blockchain technology. Through a series of insightful talks, the workshop examined key topics like mechanism design, decentralized exchange security, funding allocation, and liquidity management in decentralized systems. Below, we delve into the highlights from my favorite sessions.

Game Theoretic Attacks

The first session we are focused on is the use of game theory to identify vulnerabilities in blockchain infrastructure. Using the concept of commitments—irrevocable agreements—Daji Landis from NYU, illustrated their potential for misuse through a humorous analogy of a "doomsday machine." Smart contracts, for instance, can enable commitment attacks on transaction fee mechanisms, escrow contracts, and decentralized exchanges.

Key Takeaways:

1. Awareness of commitment attacks: Developers must consider the possibility of commitment-based vulnerabilities when designing systems reliant on game theory.

2. Resilience to attacks: While some systems show resistance to these attacks, the reasons for their resilience are not fully understood and warrant further study.

Mechanism Comparison in Blockchain Auctions

This session compared different auction mechanisms for blockchain systems, focusing on the distinction between the current Proof of Stake (PoS) model and a proposed After Prioritization of Stake (APS) model.

- PoS (Current): Auctions for block proposal rights occur concurrently with block proposals.

- APS (Proposed): Auctions take place prior to block proposals, enabling resale and altering bidding dynamics.

Through simulations, it was demonstrated that APS significantly affects revenue, allocation, and surplus distribution. The results did not outweigh the need to account for the impact of resale in mechanism design.

Mitigating Front-Running in Decentralized Exchanges

Front-running—where a malicious actor exploits knowledge of pending transactions—was another pressing topic. Angela LU from Flashbots highlighted the tension between privacy and trade execution efficiency. Confidential VMs, such as Intel TDX, were proposed as a solution.

Advantages of Intel TDX:

- Trustless Guarantee: Ensures that front-running is prevented without requiring trust.

- Unchanged Searcher Code: Works seamlessly with existing systems.

- Precise Data Control: Allows users to fine-tune the data shared with searchers.

This approach balances privacy and optimal execution, offering a promising path forward for decentralized exchanges.

Funding Allocation in Decentralized Ecosystems

Token price has long been a problematic metric for funding allocation due to its speculative nature. Alex Hajjar from Butter proposed an alternative: metric-specific prediction markets to forecast the impact of funding on measurable outcomes.

Benefits:

- Focus on Fundamental Value: Shifts attention to tangible metrics rather than speculative prices.

- Interpretable Results: Provides clear, actionable insights.

- Reduced Speculation: Decreases reliance on token price as the sole indicator of success.

Challenges include selecting appropriate metrics, addressing information asymmetry, and aligning funding objectives with long-term ecosystem value.

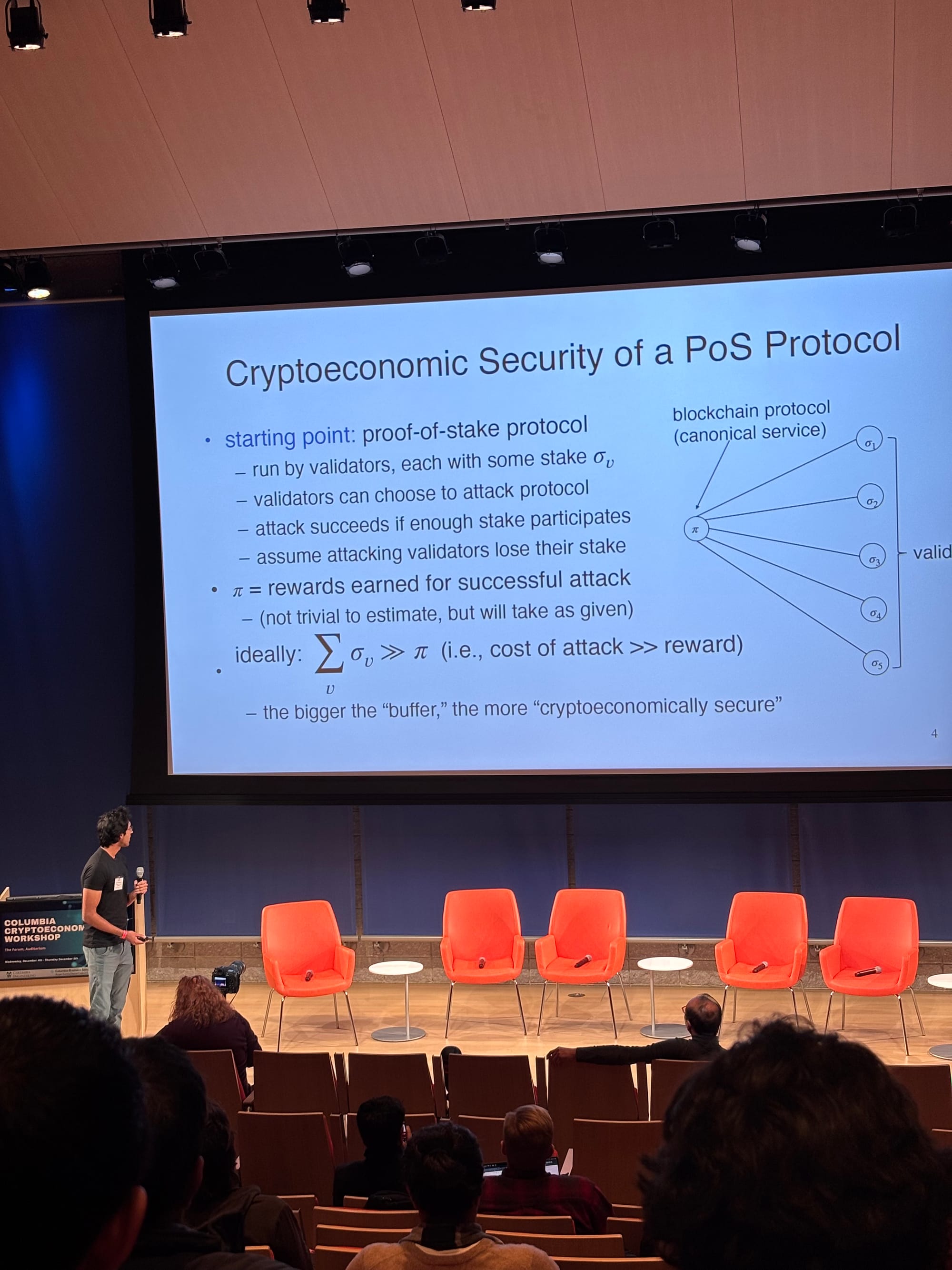

Re-Staking in Proof-of-Stake Networks

Re-staking—using staked tokens to secure multiple services—can improve capital efficiency but introduces risks. During the session, a formal model represented the re-staking network as a bipartite graph, with validators and services as nodes.

Key Insights:

- Over-Collateralization: Critical to ensuring security by making attacks unprofitable.

- Local Security: Focuses on the safety of specific coalitions of services within the network, emphasizing resilience to localized shocks.

Local security focuses on the security of a specific coalition of services within the re-staking network. It introduces the concepts of locally over-collateralized and locally small shock. The analysis shows that if a coalition of services is locally over-collateralized, then any locally small shock to their staked assets will not lead to a catastrophic loss of stake for that coalition

The analysis highlighted that robust security depends on maintaining sufficient collateralization to withstand potential disruptions.

Liquidity Fragmentation in Ethereum's Layer-2 Ecosystem

The proliferation of native Layer-2 tokens has created liquidity silos, complicating token transfers between L2s. To address this, what has been proposed by Wei Dai from 1kx are two-way canonical bridges:

1. Reverse Bridging Mechanism: System contracts on L2s would custody and reverse-bridge tokens to Ethereum mainnet using standardized interfaces like ERC-1155.

2. Canonical Bridge Tokens: L1 bridge contracts would act as custodians, enabling tokens to flow seamlessly between L2s.

This solution promotes a more interconnected and liquid ecosystem by standardizing token representation and bridging mechanisms.

Overarching Themes

The sessions collectively underscored the need for rigorous analysis, innovative mechanism design, and a nuanced understanding of participant behavior. Whether addressing attacks, improving auction mechanisms, enhancing security, or fostering liquidity, the workshop highlighted the importance of balancing incentives, system robustness, and efficiency in decentralized systems.

As blockchain technology evolves, these insights will HOPEFULLY play a crucial role in shaping resilient, scalable, and equitable systems for the future.

Have thoughts or feedback? Join Chainflow on Discord or follow us on Twitter/X!